Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨ Check the appropriate box:

| | | | | | | | |

¨ | | Preliminary Proxy Statement |

| |

¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x | | Definitive Proxy Statement |

| |

¨ | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to § 240.14a-12 |

CIDARA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply)

| | | | | | | | | | | | | | |

x | | No fee required. required |

| |

¨ | | Fee paid previously with preliminary materials |

| | |

| ¨ | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| | |

| | 1.

| | Title of each class of securities to which transaction applies:

|

| | 2.

| | Aggregate number of securities to which transaction applies:

|

| | 3.

| | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | 4.

| | Proposed maximum aggregate value of transaction:

|

| | 5.

| | Total fee paid:

|

| |

¨

| | Fee paid previously with preliminary materials.

|

| |

¨

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | |

| | 6.

| | Amount Previously Paid:

|

| | 7.

| | Form, Schedule or Registration Statement No.:

|

| | 8.

| | Filing Party:

|

| | 9.

| | Date Filed:

|

CIDARA THERAPEUTICS,

, INC.6310 Nancy Ridge Drive, Suite 101

San Diego, CA 92121

NOTICE OF

ANNUALSPECIAL MEETING OF STOCKHOLDERS

To Be Held On

June 22, 2016April 4, 2024

You are cordially invited to attend the 2016 annual meetinga Special Meeting of stockholdersStockholders (the “Annual“Special Meeting”) of Cidara Therapeutics, Inc., a Delaware corporation (the “Company”). The meeting will, to be held on Wednesday, June 22, 2016Thursday, April 4, 2024 at 8:00 a.m. (local time) Pacific Time in a virtual meeting format only, via live webcast on the internet, with no physical in-person meeting. You will be able to attend and participate in the virtual Special Meeting by entering your uniquely assigned control number at www.virtualshareholdermeeting.com/CDTX2024SM, where you will be able to listen to the virtual Special Meeting live, submit questions and vote. To participate in the virtual Special Meeting, you must have your control number that is shown on the enclosed proxy card. You will not be able to attend the virtual Special Meeting in person. As always, we encourage you to vote your shares prior to the virtual Special Meeting.

You are being asked to vote on the following matters:

1. To approve a series of alternate amendments to the Company’s Amended and Restated Certificate of Incorporation, to effect, at the

officesdiscretion of the

Company, 6310 Nancy Ridge Drive, Suite 105, San Diego, CA 92121, forCompany’s Board of Directors: (i) a reverse stock split of the

following purposes: | 1.

| To elect the two Class I directors named herein to hold office until the 2019 annual meeting of stockholders.

|

Company’s common stock, at a ratio in the range of 1-for-10 to 1-for-30, inclusive; and (ii) if and only if the reverse stock split is approved and implemented, a reduction in the number of authorized shares of common stock, at a ratio that is equal to half of the reverse stock split ratio. We refer to this proposal as the “Reverse Stock Split Proposal” or “Proposal 1.” | 2.

| To ratify the selection by the Audit Committee of the Board of Directors of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.

|

2. To approve the adjournment of the virtual Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1. We refer to this as the “Adjournment Proposal” or “Proposal 2.” | 3.

| To conduct any other business properly brought before the meeting.

|

These items of business are more fully described in the Proxy Statement accompanying this Notice.

proxy statement.

The record date for the

Annualvirtual Special Meeting is

April 25, 2016.February 27, 2024. Only stockholders of record at the close of business on that date may vote

atduring the

meetingvirtual Special Meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the virtual Special Meeting of Stockholders to be held on Thursday, April 4, 2024 at 8:00 a.m. Pacific Time, via live webcast at

www.virtualshareholdermeeting.com/CDTX2024SM.

The proxy statement is available at www.proxyvote.com.

| | | | | | | | |

| | By Order of the Board of Directors, |

| | |

| | /s/ Jeffrey Stein, Ph.D. |

| | Jeffrey Stein, Ph.D. |

| | President and Chief Executive Officer |

San Diego, California

April 29, 2016

March 4, 2024

You are cordially invited to attend the meeting in person.virtual Special Meeting. Whether or not you expect to attend the meeting, please complete, date, sign and returnvirtual Special Meeting, PLEASE VOTE YOUR SHARES. As an alternative to voting online at the proxy mailed tovirtual Special Meeting, you ormay vote overvia the internet, by telephone or by completing, dating, signing and returning the internet as instructedenclosed proxy card by mail. Voting instructions are provided in these materials, as promptly as possible in order to ensure your representation at the meeting. enclosed proxy card.

Even if you have voted by proxy, you may still vote

in person if you attendonline at the

meeting.virtual Special Meeting. Please note, however, that if your shares are held of record by a broker, bank or other

nomineeagent and you wish to vote at the

meeting,virtual Special Meeting, you must

follow the instructions from such organizations and will need to obtain a proxy

card issued in your name from that record holder.

CIDARA THERAPEUTICS, INC.

6310 Nancy Ridge Drive, Suite 101

FOR THE

2016 ANNUALSPECIAL MEETING OF STOCKHOLDERS

To Be Held On

June 22, 2016April 4, 2024

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why

didam I

receive a notice regarding the availability of proxy materials on the internet?Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, wereceiving these materials?

We have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”)these proxy materials because theour Board of Directors (sometimes referred to as the(the “Board”) of Cidara Therapeutics, Inc. (sometimes referred to as the “Company” or “Cidara”) is soliciting your proxy to vote at a Special Meeting of Stockholders (the “Special Meeting”) of Cidara Therapeutics, Inc., a Delaware corporation (“we,” “us,” the 2016 annual“Company” or “Cidara”) to be held virtually, via live webcast at www.virtualshareholdermeeting.com/CDTX2024SM, on Thursday, April 4, 2024, at 8:00 a.m. Pacific Time, and any adjournment or postponement thereof. You are invited to attend the virtual Special Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date, sign and return the enclosed proxy card, or follow the instructions below to vote over the telephone or through the internet. Stockholders attending the virtual Special Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

Only stockholders of record of our common stock at the close of business on February 27, 2024 (the “Record Date”) will be entitled to vote at the virtual Special Meeting. On the Record Date, there were 90,619,040 shares of common stock outstanding and entitled to vote (together, the “common stock”). A list of stockholders

(the “Annual Meeting”), includingentitled to vote at

any adjournments or postponements of the

Annual Meeting. All stockholdersvirtual Special Meeting will

havebe available for examination during normal business hours for the

abilityten days ending the day prior to

access the

proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.virtual Special Meeting at our address above.

We intend to mail

the Noticethese proxy materials on or about

May 5, 2016March 11, 2024 to all stockholders of record entitled to vote at the

Annualvirtual Special Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 19, 2016.

How do I attend the

Annualvirtual Special Meeting?

The meetingSpecial Meeting will be held on Wednesday, June 22, 2016Thursday, April 4, 2024 at 8:00 a.m. local time atPacific Time in a virtual meeting format only, via live webcast on the officesinternet, with no physical in-person meeting.

The virtual Special Meeting can be accessed by visiting www.virtualshareholdermeeting.com/CDTX2024SM, where you will be able to listen to the meeting live, submit questions and vote online. You may access the virtual Special Meeting using the provided link and entering your control number within 15 minutes of the Company, virtual Special Meeting’s scheduled start time.6310 Nancy Ridge Drive, Suite 105, San Diego, CA 92121. Directions

Stockholders may vote and submit questions 15 minutes before and during the virtual Special Meeting via live webcast. Appropriate questions asked during the virtual Special Meeting will be read and addressed during the virtual Special Meeting.

We recommend that you log in a few minutes before 8:00 a.m. Pacific Time to ensure you are logged in when the virtual Special Meeting starts. Online check-in will begin, and stockholders may begin submitting written questions, at 7:45 a.m. Pacific Time. You will be able to submit questions during the virtual Special Meeting as well. We encourage you to submit any question that is relevant to the Annual Meeting may be found at www.cidara.com. business of the virtual Special Meeting. The information on our website is not incorporated by reference into this Proxy Statementproxy statement.

You may vote your shares by other means during the virtual Special Meeting. See “How do I vote?” below to vote by phone, through the internet, or our Annual Reportby completing, signing and returning your proxy card in advance of the virtual Special Meeting. The proxy card that you received in the mail contains instructions for fiscal year 2015.voting by these methods. If you plan to vote during the virtual Special Meeting, you may still do so even if you have already returned your proxy.

What do I need in order to be able to participate in the virtual Special Meeting?

You will need the control number included on your proxy card or voting instruction form in order to be able to vote your shares or submit questions during the virtual Special Meeting. InformationIf you do not have your control number, you will be able to listen to the meeting only and you will not be able to vote or submit questions during the virtual Special Meeting. Instructions on how to voteconnect and participate in personthe virtual Special Meeting via the internet are posted at www.virtualshareholdermeeting.com/CDTX2024SM.

What if during the

Annualvirtual Special Meeting

is discussed below.I have technical difficulties or trouble accessing the live webcast of the virtual Special Meeting?

On the day of the virtual Special Meeting, if you encounter any difficulties with the live webcast, please call the technical support number that will be posted on the log-in page for the virtual Special Meeting for assistance.

Who can vote at the

annual meeting?virtual Special Meeting?

Only stockholders of record at the close of business on

April 25, 2016February 27, 2024 will be entitled to vote at the

Annualvirtual Special Meeting. On

thisthe record date, there were

13,962,74790,619,040 shares of common stock outstanding and entitled to vote.

A list of stockholders entitled to vote at the virtual Special Meeting will be available for examination by stockholders, during normal business hours at our principal executive offices at the address listed above, for a period of 10 days ending the day prior to the virtual Special Meeting.

Stockholder of Record: Shares Registered in Your Name

If, on

April 25, 2016,February 27, 2024, your shares were registered directly in your name with

Cidara’sour transfer agent,

American Stock Transfer &Equiniti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote

in personby virtual attendance at the

AnnualSpecial Meeting or vote by proxy. Whether or not you plan to attend the

Annualvirtual Special Meeting, we urge you to fill out and return the

enclosed proxy card,

that may be mailed to you, or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on

April 25, 2016,February 27, 2024, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and

the Notice isthese proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the

annual meeting.virtual Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your

account. You are also invited to attend the Annualvirtual Special Meeting. However, since you are not the stockholder of record, you may not vote your shares in personby virtual attendance at the AnnualSpecial Meeting unless you request and obtain a valid proxy card from your broker or other agent.

There are two matters scheduledproposals being presented for astockholder vote:

•Proposal 1: ElectionTo approve a series of alternate amendments to the Company’s Amended and Restated Certificate of Incorporation, to effect, at the discretion of the two Class I directors named hereinCompany’s Board of Directors: (i) a reverse stock split of the Company’s common stock, at a ratio in the range of 1-for-10 to hold office until1-for-30, inclusive; and (ii) if and only if the 2019 annual meetingreverse stock split is approved and implemented, a reduction in the number of stockholders;authorized shares of common stock, at a ratio that is equal to half of the reverse stock split ratio; and

•Proposal 2: RatificationTo approve the adjournment of the selection by the Audit Committeevirtual Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the Board of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.

Proposal 1.What if another matter is properly brought before the

Annualvirtual Special Meeting?

The Board knows of no other matters that will be presented for consideration at the

Annualvirtual Special Meeting. If any other matters are properly brought before the

Annualvirtual Special Meeting, it is the intention of the persons

named in the accompanying proxyacting as proxies to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify.

For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person atduring the Annualvirtual Special Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using athe enclosed proxy card that you may request or that we may elect to deliver at a later time.card. Whether or not you plan to attend the Annualvirtual Special Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annualvirtual Special Meeting and vote in persononline during the virtual Special Meeting even if you have already voted by proxy. If you have questions or need assistance in voting your shares, please call our proxy solicitor, Georgeson LLC, at (866) 358-0857 (toll free).

•VOTE IN PERSON:DURING MEETING: You may come To vote online during the virtual Special Meeting, follow the provided instructions to join the Annualvirtual Special Meeting and we will give you a ballot when you arrive.

at www.virtualshareholdermeeting.com/CDTX2024SM, starting at 8:00 a.m. Pacific Time on Thursday, April 4, 2024.

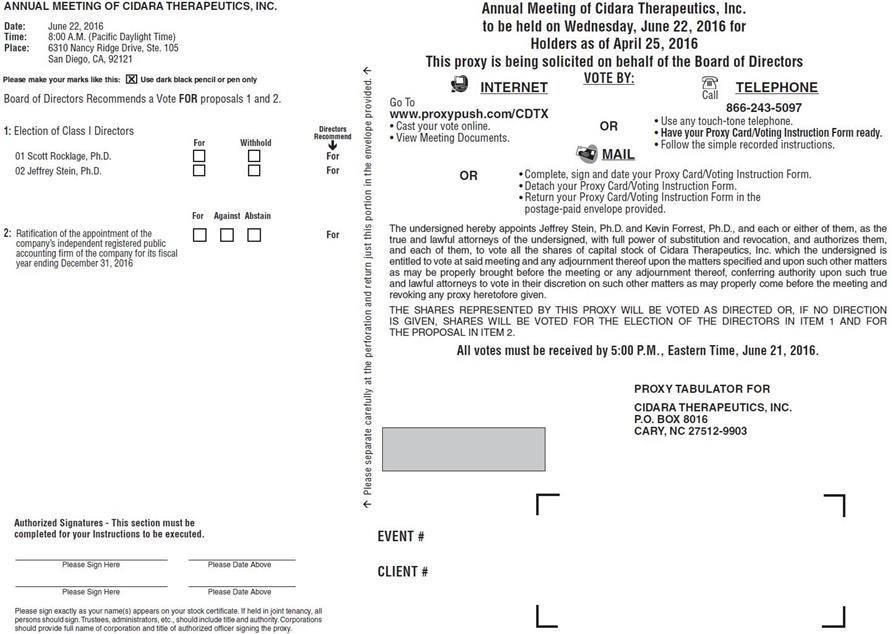

•VOTE BY PHONE: To vote over the telephone, dial toll-free 866-243-50971-800-690-6903, using any touch-tone telephone and follow the recorded instructions. You will be asked to provide the control number from the Notice.enclosed proxy card. Your telephone vote must be received by 11:59 p.m. Eastern Time on June 21, 2016April 3, 2024, to be counted.

•VOTE BY INTERNET: You mayTo vote at www.proxypush.com/CDTX toover the internet, complete an electronic proxy card.card at www.proxyvote.com. You will be asked to provide the control number from the Notice.enclosed proxy card. Your internet vote must be received by 11:59 p.m. Eastern Time on June 21, 2016,April 3, 2024, to be counted.

•VOTE BY PROXY CARD: To vote using athe enclosed proxy card, simply complete, sign and date the enclosed proxy card that may be delivered and return it promptly in the envelope we have provided or return it to Proxy Tabulator for Cidara Therapeutics, Inc., P.O. Box 8016, Cary, NC 27512-9903.Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you return your signed proxy card to us before the Annualvirtual Special Meeting, we will vote your shares as you direct.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructionsinstruction form with these proxy materials from that organization rather than from Cidara. Simply follow the voting instructions in the Noticeinstruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank. To vote in person atonline during the Annualvirtual Special Meeting, you must obtain a valid proxy fromwill need the control number included on your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxyvoting instruction form.

We provide internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on

April 25, 2016.February 27, 2024.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by

completing your proxy card, by telephone, through the internet,

by completing, dating, signing and returning your proxy card, or

in persononline at the

Annualvirtual Special Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nomineethey will still be able to vote your shares of common stock depends on whether the New York Stock Exchange (the “NYSE”) deems the particular proposal is considered to be a routine matter under applicable rules.“routine” matter. Brokers and nominees can use their discretion to vote uninstructed shares“uninstructed shares” with respect to matters that are considered to be routine under applicable rules,“routine” but not with respect to non-routine“non-routine” matters. Under the rules of the NYSE applicable rulesto brokers and interpretations, non-routinenominees, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly,The NYSE has informed us that each proposal should be considered a “routine” matter, and accordingly, we believe that your broker or nominee may notwill be permitted to vote your shares on ProposalProposals 1 without your instructions, but may voteand 2. However, this remains subject to the final determination from the NYSE regarding which of the proposals are “routine” or “non-routine.”

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares on Proposal 2.are voted in the way you would prefer, you

must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent. What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the

election of both nominees for directorReverse Stock Split Proposal and “For” the

ratification of the selection by the Audit Committee of the Board of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2016.Adjournment Proposal. If any other matter is properly presented at the

meeting,virtual Special Meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

Cidara

We will pay for the entire cost of soliciting proxies.proxies, including preparing, assembling, making available on the internet and printing and mailing this proxy statement, the proxy card and any additional information furnished to stockholders. In addition to these proxy materials, Cidara’sour directors and employees may also solicit proxies in person, by telephone, electronic mail, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also

reimburse

brokerage firms,brokers, banks,

andor other agents for the cost of forwarding proxy materials to beneficial owners.

However, please be aware that you must bear any costs associated with your internet service, such as usage charges from internet access providers or telephone companies. We have engaged Georgeson LLC to assist in the solicitation of proxies and provide related advice and information support, for a fee of $13,500 plus the reimbursement of customary disbursements.

What does it mean if I receive more than one

Notice?set of proxy materials?

If you receive more than one Notice,set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each proxy card in the Noticesproxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annualvirtual Special Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the internet.

•You may send a timely written notice that you are revoking your proxy to Cidara’s Corporate Secretary at 6310 Nancy Ridge Drive, Suite 101, San Diego, CA 92121.

•You may attendvote during the Annual Meeting and vote in person.virtual Special Meeting. Simply attending the meetingvirtual Special Meeting will not, by itself, revoke your proxy.

Even if you plan to virtually attend the Special Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or by completing an electronic proxy card at www.proxyvote.com so that your vote will be counted if you later decide not to virtually attend the Special Meeting.Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker,

bank, or

bankother agent as a nominee,

or agent, you should follow the instructions provided by your broker,

bank or

bank.other agent.

When are stockholder proposals and director nominations due for

the next

year’s annual meeting?

To be considered for inclusion in the Company’s proxy materials for

next year’sthe 2024 annual meeting, your proposal must

behave been submitted in writing by

January 5, 2017,December 29, 2023, to the attention of the

Corporate Secretary of Cidara Therapeutics, Inc., 6310 Nancy Ridge Drive, Suite 101, San Diego, CA

92121.92121, and have complied with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (“Rule 14a-8”). If you wish to submit a proposal (including a director nomination) that is not to be included in the Company’s proxy materials for

next year’sthe 2024 annual meeting

pursuant to Rule 14a-8, you must do so between February 22,

20172024 and March 24,

2017.2024, as required by our Bylaws. You are also advised to review the Company’s Bylaws, which contain additional requirements relating to advance notice of stockholder proposals and director nominations.

What are “broker non-votes”?

When a beneficial owner In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of shares held in “street name” does not give instructions todirector nominees other than our Board’s nominees must also comply with the broker or nominee holdingadditional requirements of Rule 14a-19(b) promulgated under the sharesSecurities Exchange Act of 1934, as to how to vote on matters deemed to be non-routine under applicable rules, the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

amended.

Votes will be counted by the inspector of election appointed for the Annualvirtual Special Meeting, who will separately count votes for each proposal as follows:

1.For the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, for the proposal to ratify the Audit Committee’s selection of Ernst & Young LLP as our independent public accounting firm,Reverse Stock Split Proposal, votes “For” and “Against,” abstentions“Against”.

2.For the Adjournment Proposal, votes “For” and if applicable, broker non-votes. Abstentions will be counted towards the vote total for Proposal 2“Against”, and will have the same effect as “Against” votes. Broker non-votes will be counted towards the presence of a quorum butabstentions.

Because both proposals are “routine” matters under NYSE rules, there will not be

counted towards the vote total for any

proposal.broker non-votes.

How many votes are needed to approve each proposal?

For•To be approved, the election of directors, the two nominees receiving the mostReverse Stock Split Proposal must receive “For” votes from the holders of shares present in persona majority of votes cast at the virtual Special Meeting or represented by proxy and entitled to vote on the election of directorsmatter at the virtual Special Meeting. Because this is a “routine” matter under NYSE rules, there will not be elected. Only votes “For” or “Withheld”any broker non-votes on this proposal. Abstentions will affectnot be counted in the outcome.

•To be approved, Proposal 2, the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for its fiscal year ending December 31, 2016,Adjournment Proposal must receive “For” votes from the holders of a majority of shares present in personby virtual attendance at the Special Meeting or represented by proxy and entitled to vote on the matter. If you “Abstain” from voting, itmatter at the virtual Special Meeting. Because this is a “routine” matter under NYSE rules, there will not be any broker non-votes on this proposal. Abstentions will have the same effect as an “Against” vote. Broker non-votes, if any, will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold the

Annualvirtual Special Meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares

of common stock entitled to vote are present

by virtual attendance at the

AnnualSpecial Meeting

in person or represented by proxy. On the record date, there were

13,962,74790,619,040 shares outstanding and entitled to vote. Thus, the holders of

6,981,37445,309,521 shares must be present

in personby virtual attendance or represented by proxy at the

AnnualSpecial Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your

broker,brokerage firm, bank,

dealer or other

nominee)agent) or if you vote

in person atonline during the

Annualvirtual Special Meeting. Abstentions

and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present

by virtual attendance at the

AnnualSpecial Meeting

in person or represented by proxy may adjourn the

Annualvirtual Special Meeting to another date.

How can I find out the results of the voting at the

Annualvirtual Special Meeting?

Preliminary voting results will be announced at the

Annualvirtual Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file with the SEC within four business days after the

Annualvirtual Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the

Annualvirtual Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

APPROVAL OF

DIRECTORSTHE REVERSE STOCK SPLIT PROPOSAL

GENERAL

The Board is divided into three classes. Each class consists, as nearly as possible,has approved a series of one-thirdproposed alternative amendments to the Company’s Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), that would effect:

•a reverse stock split of the total numberCompany’s common stock, at a ratio in the range of directors,1-for-10 to 1-for-30, inclusive (each of which is referred to in this proxy statement as a “Reverse Stock Split”; and each class has

•if and only if the Reverse Stock Split is approved and implemented, a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increasereduction in the number of directors, shall serve for the remainderauthorized shares of common stock, at a ratio that is equal to half of the full termReverse Stock Split ratio.

The combined effect of

that class and untileach of the

director’s successoralternative amendments (each of which is

duly elected and qualified.The Board presently has six members. There are two Class I directors whose term of office expires in 2016: Scott M. Rocklage, Ph.D. and Jeffrey Stein, Ph.D. Drs. Rocklage and Stein have been nominated for reelection at the Annual Meeting. Proxies may not be voted for a greater number of persons than the number of nominees namedreferred to in this proxy statement. Drs. Rocklagestatement as a Reverse Stock Split Amendment) is illustrated in the table below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Amendment No.1 (see Appendix 1) | | Amendment No.2 (see Appendix 2) | | Amendment No.3 (see Appendix 3) | | Amendment No.4 (see Appendix 4) | | Amendment No.5 (see Appendix 5) | | Amendment No.6 (see Appendix 6) |

| Reverse Stock Split ratio | | 10:1 | | 11:1 | | 12:1 | | 13:1 | | 14:1 | | 15:1 |

| Number of authorized shares of common stock | | 40,000,000 | | 36,363,636 | | 33,333,333 | | 30,769,230 | | | 28,571,428 | | | 26,666,666 | |

| | | | | | | | | | | | |

| | Amendment No.7 (see Appendix 7) | | Amendment No.8 (see Appendix 8) | | Amendment No.9 (see Appendix 9) | | Amendment No.10 (see Appendix 10) | | Amendment No.11 (see Appendix 11) | | |

| Reverse Stock Split ratio | | 16:1 | | 17:1 | | 18:1 | | 19:1 | | 20:1 | | |

| Number of authorized shares of common stock | | 25,000,000 | | | 23,529,411 | | | 22,222,222 | | | 21,052,631 | | | 20,000,000 | | | |

| | | | | | | | | | | | |

| | Amendment No.12 (see Appendix 12) | | Amendment No.13 (see Appendix 13) | | Amendment No.14 (see Appendix 14) | | Amendment No.15 (see Appendix 15) | | Amendment No.16 (see Appendix 16) | | |

| Reverse Stock Split ratio | | 21:1 | | 22:1 | | 23:1 | | 24:1 | | 25:1 | | |

| Number of authorized shares of common stock | | 19,047,619 | | | 18,181,818 | | | 17,391,304 | | | 16,666,666 | | | 16,000,000 | | | |

| | | | | | | | | | | | |

| | Amendment No.17 (see Appendix 17) | | Amendment No.18 (see Appendix 18) | | Amendment No.19 (see Appendix 19) | | Amendment No.20 (see Appendix 20) | | Amendment No.21 (see Appendix 21) | | |

| Reverse Stock Split ratio | | 26:1 | | 27:1 | | 28:1 | | 29:1 | | 30:1 | | |

| Number of authorized shares of common stock | | 15,384,615 | | | 14,814,814 | | | 14,285,714 | | | 13,793,103 | | | 13,333,333 | | | |

The effectiveness of any one of these amendments and Stein, each current directorsthe abandonment of the Company, have each been recommended for nomination toother amendments, or the Board at the Annual Meeting by the Nominating and Corporate Governance Committeeabandonment of the Board. If elected at the Annual Meeting, eachall of these nominees would serve until the 2019 annual meeting of stockholders and until his successor has been duly elected and qualified, or, if sooner, until his death, resignation or removal. It is the Company’s policy to invite directors and nominees for director to attend the annual meeting. We did not hold an annual meeting in 2015.Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Accordingly, the two nominees receiving the highest number of affirmative votesamendments, will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by the Company. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

NOMINEES

The Nominating and Corporate Governance Committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct the Company’s business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to believe that that nominee should continue to serve on the Board. However, each of the members of the Nominating and Corporate Governance Committee may have a variety of reasons why he believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

Nominees for Election for a Three-year Term Expiring at the 2019 Annual Meeting

Scott Rocklage, Ph.D., 61, has served as a member of our Board since 2013. Dr. Rocklage joined 5AM Ventures, a venture capital firm, in 2003 as a Venture Partner and became a Managing Partner in 2004. Prior to joining 5AM Ventures, Dr. Rocklage served as Chief Executive Officer and Chairman of the Board of Cubist Pharmaceuticals Inc., a publicly-traded pharmaceutical company, from 1994 to 2003 and as President and Chief Executive Officer of Nycomed Salutar, Inc., a diagnostic imaging company, from 1986 to 1989. Dr. Rocklage has also served in various research and development positions at Nycomed and Catalytica, Inc., a private pharmaceutical company. Dr. Rocklage currently serves as the chairman of the board of directors of Rennovia, Inc., a private bio-renewable chemical company, and Kinestral Technologies, a private technology company. Dr. Rocklage also serves on the board of directors of Achaogen, Inc., a publicly-traded biopharmaceutical company, Pulmatrix, Inc., a private biotechnology company, and Epirus Biopharmaceuticals, Inc., a publicly traded biopharmaceutical company, and previously served on the board of directors of Achaogen, Inc., a public biopharmaceutical company, Relypsa, Inc., a public biopharmaceutical company, Novira, Inc., a private pharmaceutical company, and VBI Vaccines, Inc., a public biopharmaceutical company. Dr. Rocklage holds a B.S. in chemistry from the University of California, Berkeley and a Ph.D. in chemistry from the Massachusetts Institute of Technology.

Our Board believes that Dr. Rocklage’s expertise and experience as a director of both public and private companies, his experience in the venture capital industry and his educational background provide him with the qualifications and skills to serve on our Board.

Jeffrey Stein, Ph.D., 61, has served as a member of our Board and as President and Chief Executive Officer since January 2014. Prior to joining us, Dr. Stein was the President and Chief Executive Officer of Trius Therapeutics, Inc., a publicly-traded pharmaceutical company, until its acquisition by Cubist Pharmaceuticals, Inc. in September 2013. Dr. Stein was also a venture partner at Sofinnova Ventures, a biotech venture capital fund, from 2005 to 2010. Prior to joining Sofinnova, Dr. Stein was co-founder and Chief Scientific Officer at Quorex Pharmaceuticals, Inc., a private pharmaceutical company, from 1999 until its acquisition by Pfizer Pharmaceuticals, Inc. in 2005. He has also served as a Principal Scientist with Diversa Corporation and the Agouron Institute. Dr. Stein currently serves on the board of directors of Ideaya Biosciences, Inc., a private biopharmaceutical company, and Paratek Pharmaceuticals, a publicly-traded biopharmaceutical company. Dr. Stein holds a B.S. in marine biology and an M.S. in biology from California State University—Long Beach and a Ph.D. in marine biology from the University of California, San Diego. Dr. Stein conducted his postdoctoral research in bacterial genetics as an Alexander Hollaender Distinguished Postdoctoral Fellow at the California Institute of Technology.

Our Board believes that Dr. Stein’s expertise and experience as our President and Chief Executive Officer, his perspective and experience as a founder and executive at public and private pharmaceutical companies and his expertise in life sciences and venture capital industries, provide him with the qualifications and skills to serve on our Board.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NAMED NOMINEE.

Directors Continuing in Office Until the 2017 Annual Meeting

Daniel Burgess, 54, has served as a member of our Board since April 2014. Mr. Burgess is currently a venture partner at SV Life Sciences, an investment fund, a position he has held since June 2014. From June 2011 until its acquisition by The Medicines Company in December 2013, he was the President and Chief Executive Officer of Rempex Pharmaceuticals, Inc., a private biopharmaceutical company. From December 2013 until June 2014, he ran the Rempex subsidiary of The Medicines Company. Prior to that, Mr. Burgess was President and Chief Executive Officer of Mpex Pharmaceuticals, Inc., a private biopharmaceutical company, from May 2007until its acquisition by Aptalis Pharma Inc., now a subsidiary of Actavis, Inc., a publicly-traded pharmaceutical company, in April 2011. From August 1999 to May 2007, Mr. Burgess was Chief Operating Officer and Chief Financial Officer of Harbor BioSciences, Inc., formerly Hollis-Eden Pharmaceuticals, Inc., a pharmaceutical company. Prior to joining Harbor BioSciences Mr. Burgess held positions at Nanogen, Inc., Gensia Sicor, Inc., Castle & Cooke, Inc. and Smith Barney, Harris Upham and Company. Mr. Burgess served as a director of Metabasis Therapeutics, Inc. from March 2004 until its acquisition by Ligand Pharmaceuticals Incorporated in January 2010. From July 2004 until its acquisition by Salix Pharmaceuticals, Inc. in January 2014, Mr. Burgess served on the board of directors of Santarus, Inc., a publicly-traded biopharmaceutical company. Mr. Burgess holds a B.A. in economics from Stanford University and an M.B.A. from Harvard Business School.

Our Board believes Mr. Burgess’s expertise and experience as an executive in the pharmaceutical industry and his educational background provide him with the qualifications and skills to serve on our Board.

Theodore R. Schroeder, 61, has served as a member of our Board since April 2014. Since June 2015, Mr. Schroeder has served as President, Chief Executive Officer and a member of the board of directors of Zavante Therapeutics, a private biopharmaceutical company. Mr. Schroeder co-founded Cadence Pharmaceuticals, Inc. in May 2004 and served as its President and Chief Executive Officer, and a member of the board of directors, until its acquisition in May 2014 by Mallinckrodt Pharmaceuticals, Inc., a publicly-traded pharmaceutical company. From August 2002 to February 2004, Mr. Schroeder served as Senior Vice President, North American Sales and Marketing, of Elan Pharmaceuticals, Inc., a neuroscience-based pharmaceutical company. From February 2001 to August 2002, Mr. Schroeder served as General Manager of the Hospital Products Business Unit at Elan Pharmaceuticals. From May 1999 to November 2000, Mr. Schroeder held the position of Senior Director of Marketing Hospital Products at Dura Pharmaceuticals, Inc., a specialty respiratory pharmaceutical and pulmonary drug delivery company, until its acquisition by Elan Pharmaceuticals. Prior to joining Dura Pharmaceuticals, Mr. Schroeder held a number of hospital-related sales and marketing positions with Bristol-Myers Squibb Company, a global pharmaceutical company. Mr. Schroeder is currently a member of the board of directors of Biocom, a

regional life science trade association, where he is Chairman and a member of the executive committee. Mr. Schroeder is also a current director of Otonomy, Inc., a public biopharmaceutical company, and Collegium Pharmaceuticals, a public pharmaceutical company. Mr. Schroeder previously served as a director of Hyperion Therapeutics, Inc., Incline Therapeutics, Inc. and Trius Therapeutics, Inc. until their respective acquisitions. Mr. Schroeder received a B.S. in management from Rutgers University.

Our Board believes that Mr. Schroeder’s expertise and experience as an executive in the pharmaceutical industry, as a founder of a pharmaceutical company and his educational background provide him with the qualifications and skills to serve on our Board.

Directors Continuing in Office Until the 2018 Annual Meeting

Timothy R. Franson, M.D., 64, has served as a member of our Board since March 2015. Since May 2014, he has served as the Chief Medical Officer of YourEncore, an advisory firm focused on global life sciences and consumer health companies. From 2009 until May 2014, Dr. Franson was a Principal of FaegreBD Consulting, a clinical and regulatory pharmaceutical development consulting firm and he currently maintains a relationship with FaegreBD through its strategic alliance with YourEncore. From 2008 until 2009, Dr. Franson was the Founder and President of Franson PharmaAdvisors LLC, a clinical and regulatory pharmaceutical development consulting firm which merged with FaegreBD Consulting in 2009. Prior to YourEncore and FaegreBD Consulting, Dr. Franson was Vice President of Global Regulatory Affairs at Lilly Research Laboratories, a part of Eli Lilly and Company. He joined Eli Lilly and Company in 1986. Dr. Franson also currently serves as the President of the US Pharmacopeial Convention which establishes drug quality standards enforced by regulators such as the FDA, and is integrally involved in global public health initiatives through USP, as well as on the Executive Committee of their Board of Trustees. He currently serves on the board of directors of Paratek Pharmaceuticals, a publicly-traded biopharmaceutical company, and for the Critical Path Institute, which collaborates with FDA and industry in innovation advances. Dr. Franson has authored more than 50 articles in the fields of infectious disease, epidemiology, pharmacoeconomics and antibiotic utilization, as well as four book chapters relating to innovation policy topics. He also served as a director of Myrexis (formerly Myriad) Pharmaceuticals from 2010 to 2013. Dr. Franson holds a B.S. in pharmacy from Drake University and an M.D. from the University of Illinois, College of Medicine. He is Board Certified in Internal Medicine and Infectious Diseases.

Our Board believes that Dr. Franson’s extensive expertise in the areas of pharmaceutical development and regulatory affairs provide him with the qualifications and skills to serve on our Board.

Robert J. Perez, 51, has served as a member of our Board since March 2015. He founded Vineyard Sound Advisors, LLC in March 2014 and has served as Managing Partner since its founding. From January 1, 2015 until its acquisition later that month by Merck AG, Mr. Perez served as the Chief Executive Officer of Cubist Pharmaceuticals, Inc., a public pharmaceutical development company. He joined Cubist in August 2003 as Senior Vice President, Sales and Marketing, and led the launch of Cubicin® (daptomycin for injection). He also served as Executive Vice President and Chief Operating Officer from August 2007 to July 2012, and President and Chief Operating Officer from July 2012 to December 2014. Before joining Cubist, he served as Vice President of Biogen, Inc.’s U.S. CNS business unit, where he was responsible for commercial leadership of an $800 million business. He joined Biogen in 1995, and was one of the architects of the commercial model that launched the company’s first commercial product, AVONEX®. Prior to Biogen, Mr. Perez held various sales and marketing positions at Zeneca Pharmaceuticals. Mr. Perez currently serves as a member of the board of directors of the following public companies: AMAG Pharmaceuticals, Inc., Zafgen, Inc., and Flex Pharma, Inc. Mr. Perez is also a member of the board of directors of the Biomedical Science Careers Program, a member of the Board of Advisors of Citizen Schools of Massachusetts, a member of the Board of Trustees at The Dana Farber Cancer Institute, Inc., and a member of the Board of College Bound Dorchester. Mr. Perez received a B.S. in business from California State University, Los Angeles and an M.B.A. from the Anderson Graduate School of Management at the University of California, Los Angeles.

Our Board believes that Mr. Perez’s expertise and experience as an executive in the pharmaceutical industry and his board experience provide him with the qualifications and skills to serve on our Board.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

INDEPENDENCE OF THE BOARD OF DIRECTORS

As required under the NASDAQ Stock Market (“NASDAQ”) listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our Board consults withfollowing the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securitiesvirtual Special Meeting and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of NASDAQ, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that all of our directors, except Dr. Stein who is not considered independent because he is an executive officer of the Company, are independent directors as defined by Rule 5605(a)(2) of the NASDAQ Listing Rules. In making this determination, the Board found that none of these directors had a material or other disqualifying relationship with the Company.

BOARD LEADERSHIP STRUCTURE

Our Board is currently chaired by Scott M. Rocklage, Ph.D. who has authority, among other things, to call and preside over Board meetings, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Chairman has substantial ability to shape the work of the Board. We believe that separation of the positions of Chairman and Chief Executive Officer reinforces the independence of the Board in its oversight of our business and affairs. In addition, we have a separate chair for each committee of the Board. The chair of each committee is expected to report annually to the Board on the activities of his or her committee in fulfilling its responsibilities as detailed in its respective charter or specify any shortcomings should that be the case. In addition, we believe that having a separate Chairman creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board of Directors to monitor whether management’s actions are in the best interests of us and our stockholders. As a result, we believe that having a separate Chairman can enhance the effectiveness of the Board as a whole.

ROLE OF THE BOARD IN RISK OVERSIGHT

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board, as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance practices, including whether they are successful in preventing illegal or improper liability-creating conduct. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

MEETINGS OF THE BOARD OF DIRECTORS

The Board met seven times and acted by unanimous written consent three times during 2015. All directors attended at least 75% of the aggregate number of meetings of the Board and of the committees on which they served, held during the portion of the last fiscal year for which they were directors or committee members, respectively.

In fiscal year 2015, the Company’s independent directors met four times in an executive session at which only independent directors were present.

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The following table provides membership and meeting information for fiscal year 2015 for each of these committees of the Board:

| | | | | | |

Name | | Audit | | Compensation | | Nominating and Corporate Governance |

Daniel D. Burgess................................................................................................... | | X* | | | | X |

Timothy R. Franson, MD........................................................................................ | | | | X | | X |

Robert J. Perez….................................................................................................... | | X | | X | | |

Scott M. Rocklage, Ph.D......................................................................................... | | | | | | X* |

Theodore R. Schroeder............................................................................................ | | X | | X* | | |

Total meetings in 2015 | | 3 | | 6 | | 0 |

The Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee each were constituted in connection with the closing of the Company’s initial public offering in April 2015 and did not meet prior to such time.

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable rules and regulations regarding “independence” and that each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Audit Committee

The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. For this purpose, the Audit Committee performs several functions, including, among other things:

evaluating the performance, independence and qualifications of our independent auditors and determining whether to retain our existing independent auditors or engage new independent auditors;

reviewing and approving the engagement of our independent auditors to perform audit services and any permissible non-audit services;

monitoring the rotation of partners of our independent auditors on our engagement team as required by law;

prior to engagement of any independent auditor, and at least annually thereafter, reviewing relationships that may reasonably be thought to bear on their independence, and assessing and otherwise taking the appropriate action to oversee the independence of our independent auditor;

reviewing our annual and quarterly financial statements and reports, including the disclosures contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and discussing the statements and reports with our independent auditors and management;

reviewing, with our independent auditors and management, significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our financial controls;

reviewing with management and our independent auditors any earnings announcements and other public announcements regarding material developments;

establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting or auditing matters and other matters;

preparing the report that the SEC requires in our annual proxy statement;

| •

| reviewing and providing oversight of any related-party transactions in accordance with our related-party transaction policy and reviewing and monitoring compliance with legal and regulatory responsibilities, including our code of business conduct and ethics;

|

reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management are implemented;

reviewing, on a periodic basis, our investment policy; and

reviewing and evaluating, on an annual basis, the performance of the Audit Committee and the Audit Committee charter.

The Audit Committee is composed of three directors: Messrs. Burgess (Chair), Perez and Schroeder. The Board has adopted a written Audit Committee charter that is available to stockholders on the Company’s website at www.cidara.com. The information on our website is not incorporated by reference into this Proxy Statement or our Annual Report for fiscal year 2015.

The Board reviews the NASDAQ listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of the Company’s Audit Committee are independent (as independence is currently defined in the applicable NASDAQ listing standards and Rule 10A-3 of the Exchange Act).

The Board has also determined that Mr. Burgess qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Burgess’ level of knowledge and experience based on a number of factors, including his formal education and previous and current experience in financial roles.

Report of the Audit Committee of the Board of Directors*

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2015 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 16, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

Daniel D. Burgess (Chair)

Robert J. Perez

Theodore R. Schroeder

* The material in this report is not “soliciting material,” is not deemed “filed” with the Securities and Exchange Commission and is not to be incorporated by reference in any filing of the Company under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

Compensation Committee

The Compensation Committee of the Board is composed of three directors: Messrs. Schroeder (Chair) and Perez and Dr. Franson. Our Board has determined that each of the members of our Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, or the Exchange Act, is an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code, and satisfies the NASDAQ Stock Market independence requirements. The Board has adopted a written Compensation Committee charter that is available to stockholders on the Company’s website at www.cidara.com. The information on our website is not incorporated by reference into this Proxy Statement or our Annual Report for fiscal year 2015.

The Compensation Committee acts on behalf of the Board to review, adopt or recommend for adoption, and oversee the Company’s compensation strategy, policies, plans and programs. For this purpose, the Compensation Committee performs several functions, including, among other things:

reviewing, modifying and approving (or if it deems appropriate, making recommendations to the full Board of Directors regarding) our overall compensation strategy and policies;

making recommendations to the full Board of Directors regarding the compensation and other terms of employment of our chief executive officer;

reviewing, modifying and approving (or if it deems appropriate, making recommendations to the full Board of Directors regarding) the compensation and other terms of employment of our other executive officers;

reviewing and making recommendations to the full Board of Directors regarding performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives;

reviewing and approving (or if it deems it appropriate, making recommendations to the full Board of Directors regarding) the equity incentive plans, compensation plans and similar programs advisable for us, as well as modifying, amending or terminating existing plans and programs;

evaluating risks associated with our compensation policies and practices and assessing whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on us;

reviewing and making recommendations to the full Board of Directors regarding the type and amount of compensation to be paid or awarded to our non-employee board members;

establishing policies with respect to votes by our stockholders to approve executive compensation to the extent required by Section 14A of the Exchange Act and, if applicable, determining our recommendations regarding the frequency of advisory votes on executive compensation;

reviewing and assessing the independence of compensation consultants, legal counsel and other advisors as required by Section 10C of the Exchange Act;

administering our equity incentive plans;

establishing policies with respect to equity compensation arrangements;

reviewing the competitiveness of our executive compensation programs and evaluating the effectiveness of our compensation policy and strategy in achieving expected benefits to us;

reviewing with management and approving our disclosures under the caption “Compensation Discussion and Analysis” in our periodic reports or proxy statements to be filed with the SEC, to the extent such caption is included in any such report or proxy statement;

preparing the report that the SEC requires in our annual proxy statement; and

reviewing and evaluating, on an annual basis, the performance of the Compensation Committee and the Compensation Committee charter.

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets at least quarterly and with greater frequency, if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with management. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer does not participate in, or is not present during, any deliberations or determinations of the Compensation Committee regarding his compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company. In addition, under its charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The CompensationApril 4, 2025

Committee has direct responsibility for the oversight of the work of any advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the sole authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under its charter, to the extent required by SEC and NASDAQ rules, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and NASDAQ, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

In 2015, the Company engaged Radford (“Radford”) as its compensation consultant. Radford was retained to provide an assessment of the Company’s executive and director compensation programs in comparison to executive and director compensation programs at selected publicly-traded peer companies. As part of its engagement, Radford was requested by the Compensation Committee to develop a comparative group of companies and to perform analyses of competitive performance and compensation levels for that group. Radford ultimately developed peer group and related recommendations that were presented to the Compensation Committee for its consideration.

The Compensation Committee holds one or more meetings during the first quarter of the year to discuss and make recommendations to the Board for annual compensation adjustments, annual bonuses, annual equity awards, and new corporate performance objectives. However, the Compensation Committee also considers matters related to individual compensation, such as compensation for new executive hires, as well as high-level strategic issues, such as the effectiveness of the Company’s compensation strategy, potential modifications to that strategy and new trends, plans or approaches to compensation, at periodic meetings throughout the year on an as-needed basis. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation levels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines recommendations to the Board regarding any adjustments to his compensation as well as awards to be granted. For all executives and directors as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, executive stock ownership information, company stock performance data, analyses of historical executive compensation levels and current Company-wide compensation levels, compensation surveys, and recommendations of any compensation consultant, if applicable.

Compensation Committee Interlocks and Insider Participation

As stated above, the Compensation Committee currently consists of Messrs. Schroeder (Chair) and Perez and Dr. Franson. No member of the Compensation Committee has ever been an officer or employee of Cidara. None of our executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our Board or Compensation Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, selecting or recommending to the Board for selection candidates for election to the Board of Directors, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of the Board, and developing a set of corporate governance principles for the Company.

The Nominating and Corporate Governance Committee is composed of three directors: Dr. Rocklage (Chair), Mr. Burgess and Dr. Franson. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined under applicable NASDAQ listing standards). The Board has adopted a written Nominating and Corporate Governance Committee charterrecommended that is availablethese proposed amendments be presented to stockholders on the Company’s website and www.cidara.com. The information on our website is not incorporated by reference into this Proxy Statement or our Annual Reportstockholders for fiscal year 2015.approval. The functions

Upon receiving stockholder approval of this committee include, among other things:

| ·

| identifying, reviewing and evaluating candidates to serve on our Board of Directors;

|

| ·

| determining the minimum qualifications for service on our Board of Directors;

|

| ·

| evaluating director performance on the Board and applicable committees of the Board and determining whether continued service on our Board is appropriate;

|

| ·

| evaluating, nominating and recommending individuals for membership on our Board of Directors;

|

| ·

| evaluating nominations by stockholders of candidates for election to our Board of Directors;

|

| ·

| considering and assessing the independence of members of our Board of Directors;

|

| ·

| developing a set of corporate governance policies and principles and recommending to our Board of Directors any changes to such policies and principles;

|

| ·

| considering questions of possible conflicts of interest of directors as such questions arise; and

|

| ·

| reviewing and evaluating on an annual basis the performance of the nominating and corporate governance committee and the nominating and corporate governance committee charter.

|

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also considers such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition ofProposal 1, the Board will have the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills and such other factorssole discretion, until

April 4, 2025, to select, as it deems appropriate, given the current needs of the Board and the Company,determines to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for NASDAQ purposes, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and selects candidates for recommendation to the Board by majority vote.The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: c/o Cidara Therapeutics, Inc., 6310 Nancy Ridge Drive, Suite 101, San Diego, CA 92121, Attn: Secretary, no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the first anniversary of the preceding year’s annual meeting (or in the case of the 2016 Annual Meeting of Stockholders, the 10th day following the day on which public announcement of the date of such meeting is first made). Submissions must include the name and address of the Company stockholder on whose behalf the submission is made; the number of Company shares that are owned beneficially by such stockholder as of the date of the submission; the full name of the proposed candidate; a description of the proposed candidate’s business experience for at least the previous five years; complete biographical information for the proposed candidate; and a description of the proposed candidate’s qualifications as a director. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS